I'm in My 20's and I have No Savings!

On this third installment of #AskTheTrivinos, our letter sender Camille is asking us how to deal with the pressure of not having any savings in our 20s.

If you're in your 20s and have no savings, it's important to take proactive steps to start building your financial security.

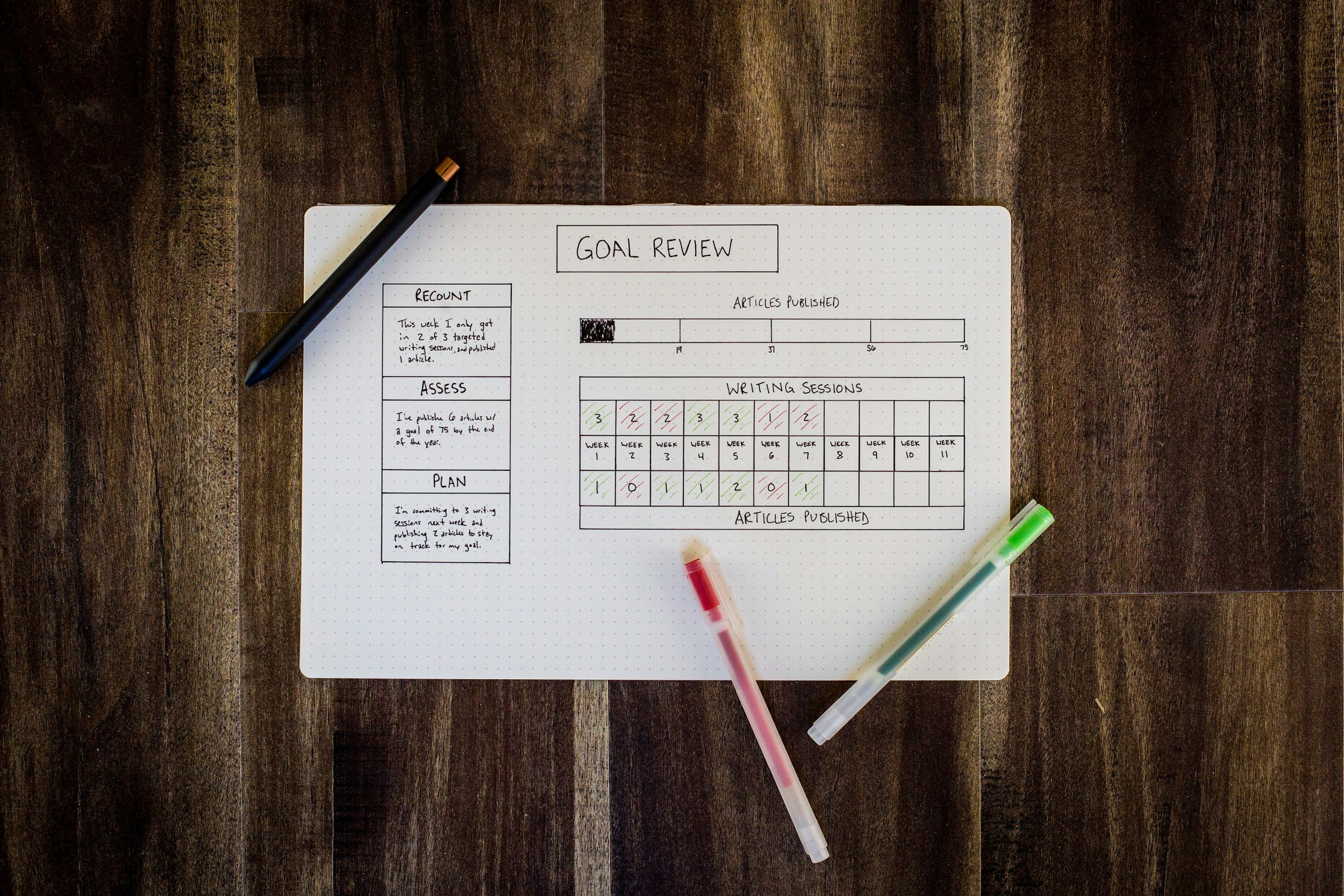

1)

Create a Budget

Begin by tracking your income and expenses. Create a budget that outlines your monthly income, essential expenses (such as rent, utilities, groceries), and discretionary spending (entertainment, dining out). Identify areas where you can cut back to free up money for savings.

2) Start Saving Regularly

Commit to saving a portion of your income each month, even if it's a small amount to begin with. Set up automatic transfers from your checking account to a savings account to make saving easier and more consistent.

3) Increase Your Income

Look for opportunities to increase your income through side gigs, freelance work, or seeking higher-paying job opportunities. Consider developing new skills or pursuing further education to enhance your earning potential.

4) Reduce Unnecessary Expenses

Identify and eliminate non-essential expenses that don't align with your financial goals. Evaluate subscription services, dining out habits, or impulse purchases that can be scaled back.

5) Educate Yourself About Personal Finance

Take time to learn about personal finance topics such as budgeting, investing, and managing debt. Resources like books, podcasts, or online courses can provide valuable insights and strategies.

If you're in your 20s and don't have savings because you're financially supporting your family, it's important to navigate this responsibility while also prioritizing your own financial well-being. Here are additional steps to consider:

1) Communicate Openly

Have open and honest conversations with your family about your financial situation and limitations. Set clear expectations and boundaries regarding the level of support you can provide while still working towards your own financial goals.

2) Collaborate on Financial Planning

Work together with your family to create a realistic financial plan. Identify areas where you can optimize spending or find alternative sources of support (such as government assistance programs or community resources).

3) Encourage Financial Independence

Empower family members to work towards financial independence by offering guidance and resources for job training, education, or career development.

4) Gradually Transition Financial Responsibility

As your financial situation improves, gradually transition some financial responsibilities back to your family members. Encourage and support their efforts towards greater self-sufficiency.

5) Stay Committed to Long-Term Financial Goals

While balancing family support, maintain a focus on your long-term financial goals. Regularly revisit and adjust your financial plan to reflect changing circumstances and priorities.

Navigating financial support for your family requires careful planning, open communication, and a balanced approach to ensure both their needs and your own financial future are addressed. By taking proactive steps and seeking appropriate support, you can navigate these challenges while making progress towards your financial goals.

From Episode 3 of #AskTheTrivinos Adulting with Joyce Pring: “Im in my 20s and I have no savings!” #AskTheTrivinos Ep3”